Valued at over $2 billion (€1.7 billion), the opportunities in the molecular imaging market are growing at a fast pace against other modalities. Despite headwinds caused by isotope supply fragility, budget caution, and reimbursement difficulties, growth remains structurally strong. This is driven by the expansion of digital imaging upgrades, reimbursement tailwinds, and the further growth of advanced imaging in the Asia-Pacific (APAC) region and other emerging markets.

The introduction of digital technology, primarily digital PET and digital SPECT technologies, has increased scan sensitivity, resolution, and capabilities. In competition with “legacy” technology, digital counterparts are winning most replacement deals across mature regions. Furthermore, the market is still expanding for legacy counterparts in emerging markets due to cost and sufficient capabilities, particularly for theranostics. The digital SPECT cadmium zinc telluride (CZT)-based replacement trend is promoting technology-driven replacement demand in particular; in response, vendors are actively refreshing their product lines and partnering with companies to introduce digital products. Siemens Healthineers’ partnership with Kromek for CZT-based detectors is a prime example.

In the U.S., reimbursement for scans is no longer tied to reimbursement codes for prostate-specific membrane antigen (PSMA) agents. This shift supports PET/CT growth and improves return on investment for both system purchases and tracers, driving feasibility and demand. In October 2023, the Centers for Medicare & Medicaid Services (CMS) also lifted the one-scan lifetime ban on beta-amyloid PET scans under Medicare.

Coverage decisions now fall to Medicare administrative contractors (MACs), which means beneficiaries are no longer limited to a single scan. Multiple scans may be approved if a MAC deems them “reasonable and necessary”. Variation of reimbursement is likely, since the coverage rests with MAC discretion, and not every claim will be paid. Still, multiple scans are expected to gain traction, especially for monitoring therapy response, tracking disease progression, or reassessing patients. The case is even stronger with anti-amyloid treatments such as Aduhelm, Leqembi, and Donanemab, which all rely on amyloid PET for patient selection, stratification, or diagnostic confirmation.

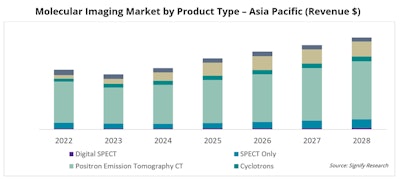

APAC market dynamics

While currently the second largest regional market, behind the Americas, Signify Research projects that the APAC market will surpass the Americas in size over the next five years.

Government initiatives and health system expansion are resulting in new installations rather than just replacements, growing the installed base as key markets in the region are building new oncology and diagnostic centers. Domestic players, such as United Imaging, are aggressive in terms of price and specifications, enabling faster adoption while expanding their current offerings to provide a full-service line.

Many markets in the APAC region have positive macroeconomic factors that are also increasing adoption, such as large ageing populations and the increasing risk of cardiac diseases, cancers, and neurodegenerative diseases.

China, in particular, has a heavy focus on building out its molecular imaging capabilities through the “Mid- and Long-term Development Plan for Medical Isotopes (2021-2023)”. The plan aims to strengthen the molecular imaging infrastructure through its “one county, one department” scheme, meaning that every county in China should have a department for nuclear medicine. Alongside expansions of the number of molecular imaging facilities, the plan involves building China’s first medical isotope test reactor for Mo-99 and I-131 to reduce import dependencies, to be operational by 2027. In the face of current tracer shortages that are limiting PET-CT scan volumes in particular, the focus on isotope supply resilience will safeguard long-term growth for China’s medical imaging market.

Western European outlook

The market in Western Europe remains a core pillar of global demand as a more mature region, but it is characterized by slower growth compared to the APAC region and North America. Much of the region’s activity is replacement-driven, with hospitals stretching the lifecycles of existing PET/CT and SPECT systems in response to budget constraints and elongated procurement cycles. This has resulted in a lengthened replacement cycle, which provides headwinds to market growth in the region.

Despite this, opportunities are emerging through technological advancements of systems in the market, largely through replacement trends into digital PET and digital SPECT systems. The improved specifications are gaining traction in tenders, as seen in North America, as hospitals strive for increased throughput, image quality, efficiency, and systems with advanced capabilities.

Reimbursement structures remain complex, with notable variations between countries, yet national initiatives in markets such as Germany, France, and the Nordics are increasing procedure growth, particularly for oncology-focused PET. Increasing adoption of theranostics, supported by EU-wide tracer research and pilot reimbursement frameworks, is also leading to incremental PET and cyclotron demand.

Over the coming years, Western Europe is expected to deliver stable, mid-single-digit growth, with technology upgrades driving premium segments, while isotope supply fragility and policy fragmentation continue to weigh on near-term momentum. Vendors with strong local service infrastructure and competitive digital offerings are best positioned to succeed in this region.

Looking to the future

The molecular imaging market is entering a new phase of opportunity, underpinned by technology innovation, reimbursement reform, and geographic expansion. While challenges such as isotope fragility, stretched replacement cycles, and reimbursement complexities remain, they are increasingly outweighed by structural growth factors.

Digital PET and Digital CZT-based SPECT are reshaping the competitive landscape in mature markets, while policy support, domestic vendor momentum, and capacity build-outs in APAC are creating entirely new demand pools. Taken together, these forces set the stage for sustained growth at a projected 6.9% over the next five years, making molecular imaging one of the most resilient and strategically important segments in the medical imaging market. Vendors, investors, and providers that align with these trends will be best placed to capture the market’s next wave of growth.

Sarah-Jane James

Sarah-Jane James

Sarah-Jane James is a senior market analyst with Signify Research’s medical imaging team. Her report, Growth Opportunities Mount for Molecular Imaging, is due to be published soon. To find out more, you can email [email protected], call +44 (0) 1234 986111, or go to www.signifyresearch.net.