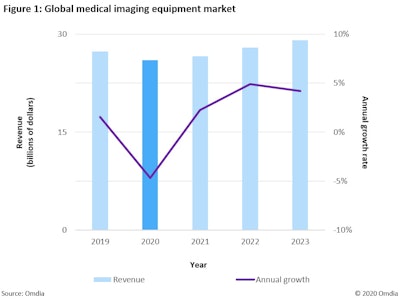

The overall economic impact of COVID-19 has been wide-ranging, affecting all industries. Medical imaging is the largest driver of the diagnostic segment of the healthcare equipment market and has experienced a wide range of fluctuation.

Mobile digital radiography (DR) has been the chief beneficiary as a result of a surge in demand for the diagnosis of COVID-19. Unit shipments of mobile DR systems are forecast to rise by over 80%. However, the overall medical imaging market is set to decline in 2020 before returning to growth in 2021.

The overall market size in 2021 will remain smaller than that of 2019 (Figure 1). At the same time, the development and utilization of artificial intelligence (AI) in healthcare has been fast tracked in 2020.

The headwinds for the medical imaging market during the COVID-19 pandemic include the following:

- Budgets diverted away from nonessential equipment

- Healthcare providers electing to extend the life of older systems

- Major decline in procedure volume

- Disrupted supply chains

- Government shutdowns

- Drop in gross domestic product (GDP)

A deep dive by modality

In 2019, revenues in the overall medical imaging market grew by 1.5% year-over-year (YoY). But in 2020, the market is forecast to decline by 4.6% YoY as revenues decline for the majority of medical imaging modalities. Major declines in the MRI and mammography markets are expected. However, demand for CT and mobile DR systems rose in 2020.

| Global market for medical imaging equipment by technology | ||

| Modality | 2019 revenues | 2020 growth |

| Total x-ray* | $10 billion | -4% |

| Ultrasound | $7.2 billion | -8% |

| MRI | $4.33 billion | -18% |

| CT | $4.15 billion | +5% |

| Nuclear medicine | $1.24 billion | -10% |

| Total revenues | $26.92 billion | |

| Annual growth | +1.5% | -4.6% |

*Total x-ray includes: C-arm, dental, fluoroscopy, general radiography, interventional, mammography, and veterinary

Source: Omdia © 2020 Omdia

Major trends across medical imaging modalities include the following:

- CT market growth has been largely driven by the rise in chronic illness, as well as the modality's utilization in diagnosis of patients with COVID-19 in Europe.

- MRI manufacturers launched several new solutions to increase efficiency, patient throughput, and utilize automated protocols; however, procedure volume and reimbursement dropped sharply in 2020.

- Ultrasound systems are being manufactured at smaller scale and at lower cost, and they have the potential to drastically expand the use of diagnostic imaging in new healthcare settings. COVID-19 will intensify not only the impact of political and economic challenges but also the emergence and acceleration of ultrasound technology. Handheld and point-of-care ultrasound systems are expected to become more prominent as they demonstrate their immense value by helping to address the pandemic

- The sharp drop in procedural volume across x-ray systems, with the exception of mobile systems, has caused a major decline in the market in 2020; however, as the number of COVID-19 cases slows, hospital budgets will be reallocated to replace and digitalize an aged install base of equipment.

Acceleration in AI adoption

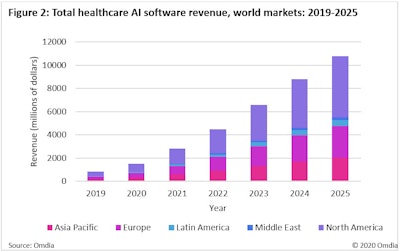

It's clear that the application of artificial intelligence in healthcare is here to stay. There is a clear indication that AI vendors are working with healthcare providers to identify practical challenges and then leverage AI to solve them. This process is crucial to successful AI adoption, as the top use cases for AI effectively address real-world healthcare problems.

The COVID-19 pandemic has accelerated the development of AI software in the healthcare sector and has provided further targeted investment in AI-based drug and vaccine research, medical imaging, and machine-learning tools for patient screening, triage, and monitoring.

Figure 2 shows the growth in the AI software market size in healthcare by revenue; the market is set to grow by 54% at a compound annual growth rate during the forecast period as industry gains come not only from investments to stem the COVID-19 pandemic but also over the medium term as countries bolster healthcare response capabilities.

The postpandemic market: Trends will be rooted in the past

COVID-19 has accelerated many trends that were already evident in the medical imaging market. The pandemic will not only intensify the impact of political and economic challenges but also the emergence and acceleration of diagnostic imaging technology. Artificial intelligence and telemedicine vendors are developing solutions to help healthcare providers meet the demands of the health crisis. These solutions will likely enhance medical imaging long after the pandemic.

Omdia's Healthcare team recently published the Medical Imaging Trends 2020 report, which provides a deep dive into the market dynamics for 11 key imaging modalities: CT, MRI, nuclear medicine, interventional, C-arms, fixed and mobile general x-ray, fluoroscopy, mammography, dental, veterinary, and ultrasound, with market size and forecasts from 2019-2023. The report is based on the collection of primary data from system manufacturers.

The comments and observations expressed are those of the author and do not necessarily reflect the opinions of AuntMinnie.com.