TORONTO - The Chinese government is heavily investing in healthcare IT infrastructure; however, the PACS and digital revolution in China is still immature, and local firms dominate despite the presence of multinational competitors, according to a presentation at this week's Medical Imaging Informatics and Teleradiology (MIIT) conference.

The rate of spending on healthcare IT infrastructure is rising in the globe's most populated country, but it will be some time before China has a highly-developed IT infrastructure that will permit the transmission of radiological images across its vast territory, according to Minglin Li, general manager for Greater China of Codonics (Shanghai) Trading Ltd. The Chinese government is spending 20 billion RMB ($3.2 billion U.S.) for healthcare IT infrastructure in 2012.

Nearly 1 million health institutions including hospitals, community health centers, village health clinics, rural health stations, and hygiene inspection offices, among other types of healthcare institutions, exist in China, and total healthcare spending has been climbing, now representing more than 5% of GDP.

The use of PACS is concentrated largely at tertiary institutions, with 80% to 90% of these facilities using PACS, while only about 10% of community hospitals are digital. The vast majority -- about 90% -- of installed systems are modality PACS, with some departmental PACS and a scattering of enterprise PACS.

"Analog isn't going away, and most hospitals still print film," said Li, noting that most images are printed on film and the culture is one where patients want to take film with them as a tangible item after their visit. "When people are paying for their healthcare, they want to get the film."

Li said there is a big push from the Chinese government to digitize healthcare, particularly in the country's rural areas. There is a plan to deploy 7,000 digital radiography (DR) units during 2011 and 2012 in China. "Not every health station will have [digital] radiology equipment, but a good percentage will," Li said.

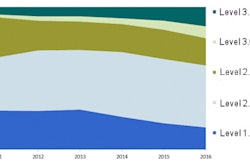

In 2011, the Chinese PACS market was 1.04 billion RMB ($164.4 million). It is projected to rise to 2.6 billion RMB ($411.2 million) by 2015, according to statistics from Huatong Health. Li placed PACS adoption in China, however, at about eight to 10 years behind the U.S. market.

The Chinese PACS market is mainly focused on hardware rather than software, and most PACS that have been deployed are not Web-based. Concepts such as mobile viewing and cloud storage are very new ideas, with one multinational company very recently launching mobile PACS in China. The current infrastructure would make the implementation of these concepts a challenge, according to Li. China's Internet speed currently ranks 90th in the world, and speeds of 200 Kbps are the norm.

The PACS software market in China was worth 280 million RMB ($44.3 million) in 2011 and is expected to climb to 710 million RMB ($112.3 million) by 2015.

"The overall numbers are small compared to expenditures in North America considering the size of China's population, but overall PACS adoption is still in its infancy," Li said.

Multinational companies are trying to make inroads in the PACS market, but to date they are being hindered by local companies, which are more competitive in terms of price and continue to capture the lion's share of the PACS market. "The local companies are winning the deals," Li said.

In a highly fragmented marketplace, the top three companies in the market are Huahuai (15.8%), Tianjian (8.8%), and Neusoft (7.9%). Global players such as GE Healthcare, Carestream Health, Anke, and Star each have between 3% and 4% of the market. Fujifilm Medical Systems and Landwind each have between 2% and 3% of the market. Just over a third (36.8%) of the market is taken up by other local companies.

A drawback to such a segmented PACS market is the challenge of developing standards, noted Li.

"One of the difficulties with a very fragmented market is that it is difficult to persuade people to join forces to define a common standard," Li said. "Everyone has their own solution."

And given that the PACS market is presently focused on hardware and the networks are largely internal, issues such as integration, standards, security, privacy, and service are not foremost in the functioning of PACS in China.

"In North America, it is a service business," he said. "It is not about hardware sales."

But that may change: The drive to establish regional health networks in China and modernize to digital formats may make these issues more significant, Li said. Because there is poor investment in software, high-end applications for decision support are lacking.

"There is a perception of a lack of value of software," he said.