"Progress is impossible without change, and those who cannot change their minds cannot change anything." – George Bernard Shaw

The above quote sums up neatly a concern in European radiology IT today: Technological innovation has changed almost every aspect of society, yet for the most part there has been no change in radiology IT.

Processing speed has increased, advanced visualization has become more complex, and access has improved, but little has changed for the most part. Computer-aided detection (CAD) is still underutilized and barely used. Imaging sharing within and between providers is poor. Departmental PACS and RIS still dominate. Procurement regularly "rolls on" contracts with the same incumbent vendor, rather than face migration.

Outside radiology, it is a different story. Perhaps less encumbered by more than 20 years of legacy implementation, IT is rapidly changing the way healthcare is managed and delivered. Change for radiology IT is thus inevitable, as it is no longer an island unto itself.

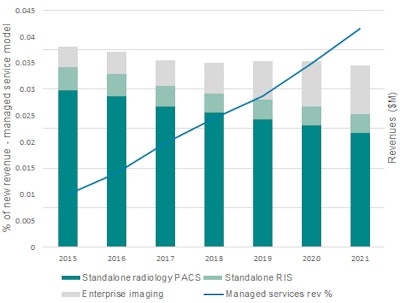

Source: Signify Research.

Source: Signify Research.In Europe, long a bastion for "traditional" radiology IT, the rate and scale of change are particularly daunting. Yet there many market changes that will shape radiology IT in Europe in the future.

Here's my view on three things providers and vendors need to get right:

1. Enterprise, with conditions

The expansion of digital technology across the healthcare enterprise has been brewing for some time. Across the Atlantic, healthcare networks are proliferating at a staggering rate. Aided by a relentless legislative program, hospital digitalization and electronic medical record (EMR) adoption were enforced by threatening to penalize providers where it hurts most -- their profits. This approach also catapulted radiology IT from basic departmental software into a multisite enterprise network spanning states. The merits of this bold approach remain questionable, especially given the limited imaging interoperability across U.S. health providers and networks. However, you can't argue they haven't at least tried to change.

In Europe, this sweeping approach is virtually impossible, given the multistate nature of the region. Given the current fragmented, complex, and aging infrastructure, any grand visions should be reined in; a pan-European healthcare IT network is a far-off pipe dream.

Instead, the focus for transitioning to enterprise radiology IT in Europe countries should have four central priorities:

- Expansion (from department to multisite, multiprovider, multiregion) only where clear return on investment can be proved, based on clear, reporting of operational analytics

- A step-wise, standards-based approach to integrating non-DICOM content from other clinical specialities and the EMR, in which content can be stored, used, and returned in native format

- Establishment of multivendor, "minimum-capability" procurement frameworks to act as a blueprint for providers and vendors alike

- Radiologists and clinical information officers to remain as central stakeholders within the procurement decisions

A few visionary countries in Europe are well ahead of the curve in embracing enterprise radiology IT, including Denmark, Finland, and the Netherlands. Yet the largest markets (Germany, France, U.K., Italy, Spain, and Portugal) have lagged well behind. Some sites have made progress, expanding departmental PACS into regional multisite networks with a single PACS vendor. This has some operational benefits and allowed greater sharing of imaging data within a region, but also it has led to vendor regionality and protectionism. Rarely, too, have these met the criteria for standards adoption, operational analytics, and framework establishment.

With pressure mounting for more connected care and integration of health data, and with enterprise EMR vendors looking at Europe as their next hunting ground, the transition of radiology IT into enterprise networks is inevitable. The harder question is by what means should this change happen.

2. Innovation and incumbency

Business model shifts are further confusing the issue. As enterprise IT networks seep into healthcare, so too are new financial business models. Managed services, of which there are multiple types, are starting to penetrate the procurement process. Flat-fee subscription models for radiology IT software, services, and hardware make sense for providers in theory, allowing improved financial predictability, less administration, and long-term stability.

In some cases, this approach is also being expanded to cover the complete supply and maintenance of all imaging modality hardware, software, and even devices and supplies across all clinical departments in deals up to 15 years. By bundling products and software together in long-term managed service deals, the healthcare provider benefits from cost-savings, operational efficiency, integration, and a reduced administrative burden associated with multivendor contracting and ongoing maintenance.

However, there is a trade-off. The complexity of technology, both software and hardware, in today's hospitals is extensive. Expecting one vendor to supply and maintain this complexity, over a long term is a big ask. New technology or innovation from other vendors cannot be accessed, limiting access to best-of-breed functionality. Implementation can steamroller legacy systems, often leaving a trail of old systems requiring compliance checks, integration, or retirement.

Therefore, providers should approach managed service contracting with caution and not jump in with both feet. Instead, proper investigation as to the long-term benefits and trade-offs of managed service procurement should be investigated. Few case studies exist today, so available evidence to back up vendor claims is scarce. Current capital budget cycles will hinder adoption in some regions. Greater choice and innovation of business models in radiology IT should be encouraged, but its implementation must be based on clear evidence.

3. Vanishing patients

25 May 2018: For many, this date has little meaning.

However, this is the date set for the European Union's General Data Protection Regulation (GDPR), and a new legal framework for handling personal and sensitive personal data will come into force. After this date, noncompliance will have far greater penalties, with significant fines for both data controllers (e.g., healthcare providers) and data processors (third-party contractors that also access personal data). Therefore, for radiology IT and the wider healthcare market, this is a big issue.

While the extent and complexities of the new regulation extend far beyond the scope of this article, a few aspects are particularly pertinent to healthcare providers:

- Consent: "Opt-in" consent will become mandatory and need to be far clearer on specific purpose of use before.

- The right to be forgotten: Citizens have will soon have the right to be "forgotten" from a system and have all their personal data removed.

- Conformity: Any organization, both in the EU and outside the EU, must conform when handling data of EU citizens (both data controllers and processors).

- Joint liability: Organizations and third-party outsourcers are jointly liable for breaches and compliance.

On the face of them, the above points appear relatively harmless, but when put in context, the complexities of these changes are apparent. For example, will clinical research in radiology be hindered by consent issues, even with pseudoanonymized data? Could a citizen request to be removed from a study or past study?

Or in the case of teleradiology, will an outsourced provider need to be formally checked by the contracting hospital? What about distributed international teleradiology, when the image is read outside the EU?

And will the recent trend of radiologist peer-reviewing images via WhatsApp or remote portals on personal devices continue to be allowed?

The new regulations certainly bring a headache for healthcare providers, especially with the threat of heavy fines looming. Adoption of teleradiology and outsourcing (archiving, public cloud networks) is most likely to slow down, as providers and vendors come to terms with the regulations and work with partners to ensure compliance. Clinical researchers in radiology will also need to review consent practices, especially among international research collaborators. Class-action lawsuits for healthcare data breaches will become more commonplace.

Change is coming ...

Stephen Holloway is a principal analyst and the company director at Signify Research.

Stephen Holloway is a principal analyst and the company director at Signify Research.The last 20 years has seen a major development in the transition from film to digital and tremendous improvement in radiology IT capability. But this transition has led radiology facing more uncertainty than arguably ever before. Controlling the transition to enterprise health IT, navigating new business models, and adopting new data protection laws are complex challenges facing European radiology today. At the same time, artificial intelligence development further threatens the role of radiology relevance in healthcare, as explained in a previous column.

So, among all this uncertainty, perhaps there is one constant: Change waits for no person, even if they are a radiologist.

Stephen Holloway is a principal analyst and the company director at Signify Research (www.signifyresearch.net), a health tech, market-intelligence firm based in Cranfield, U.K.

The comments and observations expressed herein do not necessarily reflect the opinions of AuntMinnieEurope.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.