Digital, flat-panel detector (FPD) radiography x-ray is today so dominant for new installations in European hospitals that it is challenging to find film-based x-ray. However, with a vast array of apparently similar systems on offer, it has also become harder to detect where the market is headed. Here's my view on the key themes in digital x-ray (DR) to keep an eye out for.

Mobile DR pushes into value segment

The rapid penetration of mobile DR systems is predicted to continue. Mobile DR has seen significant growth as the benefits and return on investment for providers in terms of efficiency and radiographer time are evident. Add to this steadily declining FPD pricing and a large installed base across Europe of aging analog mobile x-ray systems creates a strong driver for growth.

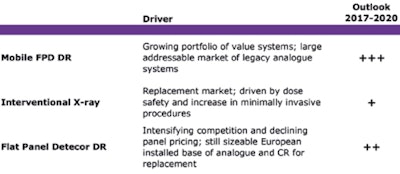

Comparison of main growth drivers for key DR markets in Europe. Source: Signify Research 2017.

Comparison of main growth drivers for key DR markets in Europe. Source: Signify Research 2017.To capitalize on this, vendors are releasing a variety of new systems focusing on value, combining previously high-end features such as touchscreens or untethered wireless panels, with lower-priced gadolinium oxide (GdOx) FPD within smaller, more mobile packages. These systems are then priced to compete against digital "retrofit kits" that can convert analog systems to DR, and a number allow optional upgrade to more expensive Caesium Iodide (CsI) FPDs at a later stage.

Advanced dose monitoring for interventional x-ray

The interventional x-ray market has been buoyed by growing acceptance of interventional procedures and minimally invasive surgery in Europe. However, with increased use comes greater radiation dose scrutiny. The market is therefore already following the trend observed in CT, using new technology to more accurately monitor dose and optimize the balance between radiation dose and system performance for common procedures. Traditionally, dose calculation has been a rudimental measure, but over time has become more tailored to each unique patient and procedure.

Stephen Holloway is principal analyst and company director at Signify Research.

Stephen Holloway is principal analyst and company director at Signify Research.New systems now commonly include smarter dose tracking based on the exam being performed, patient attributes, and automatic scan program adjustment. Many of these features are also part of wider dose-monitoring platforms for integrated use across different modalities, enabling seamless tracking of patient dose between departments.

Greater awareness of radiation dose added focus on clinician safety too, with many dose-monitoring platforms focusing on physicians and clinical staff conducting procedures. In addition, vendors are increasingly offering clinical staff training to help raise awareness and drive best practice. While there are still significant improvements to be made in universal benchmarking of dose for the growing uses of interventional x-ray, recent dose advances look set to be a major driver of legacy interventional system upgrade in the next five years.

FPD prices continue to tumble with competition

A quick tour of the ECR 2017 exhibition floor highlighted the continued proliferation of FPD vendors, especially from Asia. Price erosion of radiography detectors has ranged from 5% to 15% year-on-year in Europe for the past decade, making FPD more affordable and available. The quality and variety of models available has also skyrocketed, with both GdOx and CsI detectors now available, wired and wireless, in a multitude of sizes. Many also now have improved battery life, support automatic exposure detection, and have become increasingly robust to reduce the chance of damage.

Looking forward, as volumes of FPD installs steadily increase, price erosion will continue with intensified competition between the growing number of suppliers. OEM supply chains for major modality suppliers will also evolve with new market entrants and changes to upstream supply (such as the recent Varian Imaging division spin off to form Varex Imaging Corporation and market entry of LG Electronics). However, with FPD well established for DR, healthcare providers will be keenly scrutinizing image quality and cost to ensure new DR systems are passing on the benefits of FPD market expansion.

Editor's note: The image used on the home page to introduce this article is a supine view of the abdomen after application of SimGrid software, which aims to reduce high frequency scatter noise in x-ray images. Image courtesy of Samsung, originally appeared in ECR Today on 5 March 2017.

Originally published in ECR Today on 5 March 2017.

Copyright © 2017 European Society of Radiology