The global trend toward higher slice CT equipment has been evident in Europe during the past decade, but with increasing economic uncertainty, purchasers must now tightly balance return on investment, image quality, and clinical applications, in the face of drastically decreasing budgets. Suddenly, and despite the best efforts of manufacturers, there is no guarantee that European hospitals will continue to opt for higher and higher slice CT systems. In fact, evidence suggests the transition toward higher slice CT systems will stabilize at 64 slices.

In the total European market, 16-slice CT systems accounted for the largest share of units sold in 2010. This is indicative of the heterogeneous nature of the markets in Eastern versus Western Europe. Eastern Europe is behind the technological advances and requirements for advanced CT imaging in Western Europe. Consequently, 16-slice systems account for the majority of units purchased in Eastern Europe -- as many as 63.8% of total units sold in Poland in 2010, for example. However, as the demands of cardiac imaging and enhanced image quality increase here, so too the share of 64-slice equipment is projected to rapidly increase at a compound annual growth rate of 16.5% from 2010 to 2015. This analysis thus focuses on Western Europe.

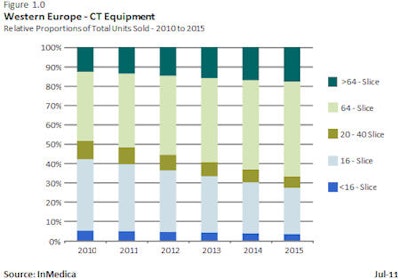

In Western Europe, 64-slice systems are projected to overtake 16-slice systems as the largest number of units purchased from 2011. This is consistent with the global transition to higher slice CT equipment. However, the bulk of demand here stops at 64 slices. Although sales of CT equipment with more than 64 slices are increasing rapidly, they are dwarfed by that of 64-slice systems. In 2010, 64-slice equipment was estimated to account for 35.7% of total CT units sold in Western Europe, as compared with 12.8% for CT systems with more than 64 slices. By 2015, 64-slice systems are forecast to grow to 48.6% of total CT units sold that year, while units with more than 64 slices will account for only 18.1% (figure 1.0).

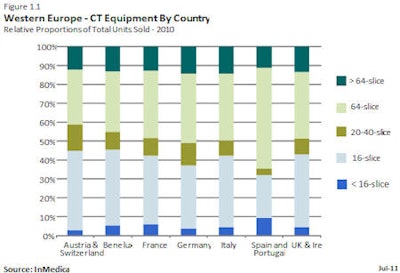

The largest CT country markets in Western Europe -- Germany, France, and Italy -- are experiencing this trend, and so too are the smaller ones, including Spain and Portugal, Austria, and Switzerland (figure 1.1). Western Europe is also slightly ahead of the U.S. in the transition to 64-slice systems. Hospitals tend to install higher slice CT equipment, including 64-slice systems, whereas imaging centers generally favor lower slice systems; the U.S. has a larger proportion of imaging centers with lower slice systems than Europe does. Furthermore, CT procedural volumes are thought to be increasing faster in European hospitals than in outpatient centers, favoring the market for higher slice equipment.

As procedural volumes per CT scanner are projected to increase, so too must purchasers seriously consider their return on investment (ROI). Hospitals that have purchased CT equipment with more than 64 slices are even more dependent on increasing patient volume, while waiting for reimbursement rates to rise to prerecession levels. During the next five years, however, those that have recently acquired 64-slice systems are projected to generally obtain the better ROI. Despite lower reimbursement rates, these systems are forecast with higher procedural volumes than systems with higher than 64 slices. This will continue to drive the market for 64-slice CT equipment in Europe. Consequently, the trend toward higher slice systems in Western Europe is reaching equilibrium, where 64-slice CT remains the dominant model.

Interestingly, there is no clear evidence that a failure to transition to higher slice CT systems beyond 64 slices will limit the diagnostic benefits of CT imaging. In cardiac imaging (CT angiography [CTA]), 64-slice CT equipment has become the modality of choice, and cardiologists do not seem universally convinced of the clinical benefits more than 64 slices. Moreover, it has always been a limitation of CTA to provide only anatomical data. This is not addressed by systems with higher than 64 slices, any more than it is by 64-slice equipment, leading to a debate on how much image enhancement is sufficient above 64 slices. It subsequently becomes increasingly difficult for hospitals to justify the added costs of higher slices.

There is also growing evidence that adding PET to 64-slice CT equipment achieves more clinical and financial benefits in CTA than upgrading to higher slices: Clinical benefits result from the additional perfusion information that PET provides to supplement the anatomical data from CT, while financial benefits are gained by preventing unnecessary revascularization procedures.1 Advances in the CT market will hence continue to be influenced by developments in related imaging modalities, not least of which will be PET/CT. This suggests the future of CT will stabilize at 64-slice systems and further development will have to rather focus on supplementing 64-slice images with hybrid systems and techniques for noise and dose reduction.

Reference- SCCT: Cardiac PET/CTA improves diagnosis and planning. Auntminnie.com, 15 July 2011.

Theo Ahadome is an analyst at InMedica (www.in-medica.com), the brand name of IMS Research's medical market research group. The information in this article is obtained from InMedica's report on the "World Market for CT and PET-CT Equipment -- 2011 Edition." For more information, contact Diane Wilkinson -- Research Manager, InMedica, Tel. +44 1933 402255, [email protected].

The comments and observations expressed herein do not necessarily reflect the opinions of AuntMinnieEurope.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.