Radiology-focused business intelligence solutions are already gaining traction in the U.S. Vendors are therefore looking at Europe as the next market for adoption, but because the continent has added complexity due to large differences between health systems and radiology practices between individual countries, entering Europe with a new radiology business intelligence product requires careful consideration.

This article discusses the nuances that will drive or inhibit adoption of medical imaging business intelligence and determine which European markets will be the pioneers in the next phase of digitalizing radiology.

Overall, four main factors are influencing the adoption of these new business intelligence and analytics tools that are intended to provide more radiology- and modality-focused analytics to help improve departmental performance and profitability:

1. Ongoing hospital consolidation and need for tight cost control

The hospital consolidation wave in the U.S. was largely caused by the need to reduce costs by benefitting from economies of scale and thereby increasing profitability. Enterprise imaging was used to simplify and standardize the medical imaging workflow as part of this process, and business intelligence is now adding an extra layer of control on top of these larger multidepartmental and multisite imaging platforms. Searching for new potential target markets should, therefore, include an assessment of a country's hospital consolidation status.

Looking at Europe, the healthcare landscape is fundamentally different due to a much larger public sector, but many of the same mechanisms often apply here. Some countries have already created tightly connected regional networks with consolidated enterprise imaging solutions. Some nations have created the networks but not yet adopted enterprise imaging to the same degree, while others are in the very beginning of the consolidation process and are still highly fragmented with regards to imaging IT and collaboration between hospitals.

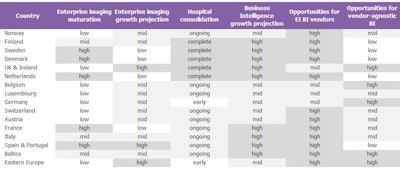

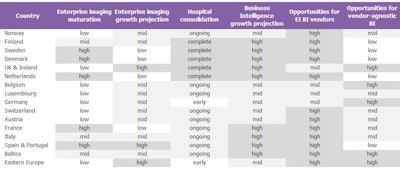

European opportunities for business intelligence in medical imaging

Source: Signify Research.

In the first group, we have countries such as the Netherlands, Sweden, Denmark, and Spain where consolidation has already taken place and enterprise imaging deals are often regional. In Italy, regional tenders have been the norm for several years, but the transition to enterprise imaging has not yet seen the strong progression. The third group of countries, where consolidation is currently taking place or is yet to start, includes Norway, which is currently undergoing heavy consolidation to optimize the healthcare system. Germany has a high number of smaller hospitals compared with its population density, which have to date been serviced mostly by local PACS vendors but will start to see consolidation in the coming years as a consequence of increased focus on performance and high healthcare expenses. Also, Poland is currently undergoing consolidation and has a strong focus on optimizing operational efficiency through telemedicine and other initiatives.

2. Differences in enterprise imaging maturation

The compound effect of this trend toward consolidation across Europe is the laying of foundations for enterprise imaging. In centralizing imaging and associated clinical content, there are numerous operational and clinical benefits. Some vendor platforms are consolidating, focusing on offering enterprise-wide access and integration to functions such as advanced visualization, contextual data analysis, and increasingly, artificial intelligence tools to support diagnosis.

The most mature markets for enterprise imaging are the Netherlands, Sweden, Denmark, and Spain, closely correlated to the trend for consolidation across the health system. Yet other countries such as Romania, Hungary, and Ukraine have only recently installed first-generation PACS after transitioning from analog modalities, creating a diverse market. Even some of the very advanced countries when it comes to healthcare procurement have lower enterprise imaging maturation. In Europe, the U.K. still predominantly follows a departmental approach to imaging IT. Despite tight regional and specialty trust networks in the U.K., healthcare providers have traditionally followed a strict best-of-breed approach making enterprise-wide implementations challenging. Italy and Germany also have both struggled to move toward multiclinical enterprise-wide imaging IT solutions.

This is relevant for business intelligence adoption in radiology today because many of the solutions on the market are part of enterprise imaging vendors' product portfolios. Recent acquisitions in this industry, with larger imaging IT vendors snapping up workflow and business intelligence specialists, have transformed the competitive landscape and the way these products will enter the market. Companies are increasingly using business intelligence strategically to protect their installed base, or by "challengers" to demonstrate potential cost-savings obtainable by replacing components from the incumbent vendor.

Vendors will therefore try to push their business intelligence solutions to their existing imaging IT customers to prevent competitors from gaining a foothold at these sites. In the meantime, companies with standalone vendor-agnostic business intelligence solutions will struggle to penetrate European markets with high enterprise imaging adoption, unless their solutions add significantly more value to the healthcare provider. These vendors should therefore look to penetrate markets with relatively low enterprise imaging maturation and growth projections, because much of the business intelligence revenue in mature enterprise imaging markets will go to firms installing the central imaging IT platform.

3. Scale affects business intelligence adoption

Looking at the initial early adopters of medical imaging focused business intelligence, larger hospitals are highly represented. In fact, 36% of the revenue in the U.S. in 2018 came from hospitals larger than 500 beds, although looking at wider imaging IT, only 18% of revenue came from this segment. In Europe, the early adoption has been very similar with primary uptake from the large hospital segment. However, we do not expect this ratio to continue much beyond early adoption.

Instead, growth looks set to start coming from the midsize hospitals down to the small hospitals and outpatient radiology clinics. Many of the larger hospitals actually already have established business intelligence solutions in place -- either self-developed or based on general business intelligence software -- so further penetration in this segment will require substantial efforts in both targeted product features and value added beyond most first-generation systems from enterprise imaging vendors. There is likely to be a gradual shift in growth toward small and midsize hospitals because many off-the-shelf business intelligence solutions from enterprise imaging vendors are well suited for this segment and will require little customization for implementation. Meanwhile, vendors with more advanced business intelligence solutions will continue to penetrate the large hospital segment.

4. Private healthcare market will adopt business intelligence faster

The private healthcare market is often adopting new technology faster as the procurement process is simpler and the focus on profitability is greater. Europe is dominated by public healthcare particularly in the acute care segment. However, an increased focus on private radiology and outpatient clinics owned by private equity firms means some countries will see a shift toward a larger private sector. With operational costs rising, public markets supported by nongovernment payers, such as insurance companies, will also increasingly focus on efficiency improvements. Therefore, vendors with business intelligence solutions for radiology should look at countries with a growing private radiology market, or those with a significant presence of nongovernmental interested parties.

Adoption pattern across Europe

Although business intelligence will see increased demand in the coming years, the adoption in Europe is expected to vary greatly between individual countries. Most early adoption has occurred in Sweden, Denmark, the Netherlands, and France, but we also expect high uptake in the U.K., Finland, Spain, Italy, and the Baltic states. More moderate uptake is likely in the midterm from Germany, Austria, Switzerland, Eastern Europe, and Norway.

Ulrik Kristensen, PhD.

Ulrik Kristensen, PhD.However, because these countries are very different when it comes to wider imaging IT setup, the opportunities will depend on the go-to-market strategy of the individual vendor. In countries with a strong enterprise imaging culture and regional presence of enterprise imaging vendors, most opportunities are expected to go to enterprise imaging vendors with business intelligence modules. In other countries with a high proportion of departmental PACS or best-of-breed approach, vendor-agnostic business intelligence vendors should put most of their efforts into penetrating the market.

For further reading, "Imaging IT: Operational and Workflow Tools - World - 2019" provides a highly detailed, data-centric analysis of the world market for Workflow Orchestration and Business Intelligence. Key features include trend analysis, market size estimates, annual growth rate forecasts for 2018 to 2023, and vendor market share analysis.

Ulrik Kristensen, PhD, is a senior market analyst at Signify Research, a health tech, market-intelligence firm based in Cranfield, U.K. He leads the research covering the advanced visualization, imaging IT, business intelligence, and genomics markets.

The comments and observations expressed are those of the author and do not necessarily reflect the opinions of AuntMinnie.com or AuntMinnieEurope.com.