Few will deny that healthcare is changing. Care delivery models are increasingly moving toward interdisciplinary care, combining the expertise of different physicians to deliver managed, longitudinal care pathways for patients. Technology is also reshaping diagnosis, advancing the performance and capabilities of medical imaging hardware while augmenting diagnostic interpretation with software tools and artificial intelligence (AI).

For radiology, which has often been at the forefront of technological and clinical advances, this evolution creates a significant opportunity to take a leading role in a new era of diagnosis. However, significant challenges must be overcome, including a change in attitude to radiology software adoption.

Europe's preponderance for best-of-breed radiology IT versus broader multidepartment enterprise solutions is a potential limiting factor for radiology in the future. The European market remains staunchly focused on procurement of IT software for radiology-only. While many solutions are marketed as "enterprise imaging," few have the capability to support multiclinical information sharing.

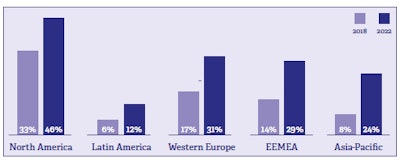

Our recent analysis of the market proves this. Only 17% of radiology IT revenues in Europe last year were for enterprise solutions, compared with 33% in North America. Most implementations were also only enterprise in nature in connecting different radiology departments together; a far smaller proportion has the capability to manage and share information from different clinical departments such as oncology, cardiology, or surgery. Over the next five years, we forecast this proportion to only increase to 31% in Europe, far behind the 46% forecast in North America. In many cases, radiologists and procurement teams argue that advanced capabilities in radiology, or "best of breed," offers higher diagnostic quality and thus outweighs the value of clinical interoperability. Looking ahead, this argument could hold less weight than before in the context of broader care collaboration.

EEMEA = Eastern Europe, Middle East, and Africa.

EEMEA = Eastern Europe, Middle East, and Africa.Interdisciplinary diagnosis and care management are already common in some markets today. For example, multidisciplinary "tumor boards" for managing the treatment of cancer have for some time utilized the collective specialization of oncologists, surgeons, pathologists, radiologists, and other clinical care staff. Too often, though, managing and sharing clinical content between these departments have been impossible. Slow adoption of electronic medical systems (EMR) has been partly to blame in some European countries, though EMR is rarely the right platform for complex clinical data management; medical imaging, genomics information, and pathology slides have, therefore, had to be manually collated. Often, selection of proprietary PACS software without mature interoperability can be a significant contributor. Moreover, it does little to help the reputation of radiology as a collaborative and open discipline.

As the scale and complexity of health networks grow, radiologists will also increasingly find procurement decision-making will move up the leadership chain, away from clinical leadership. This will make acquiring "best-of-breed" radiology IT harder and slower, especially if interoperability with other departments and systems is compromised. While some radiologists may see this as a threat to their ownership of the software and tools they use every day, it should instead be viewed as an opportunity to build consensus and partnership among clinical faculties. This can help to establish the radiologist as a central leader within interdisciplinary care models. In the U.S., for example, many radiologists feared that enforced adoption of EMR, which often led to the replacement of best-of-breed RIS with enterprise hospital information systems (HIS) would impact their work.

While there was some short-term pain, two things have occurred. First, many of the best-of-breed RIS features migrated into a new generation of PACS or were applied to existing systems through upgrades. Second, radiologists are today able to increasingly access information from across the health network, maximizing the availability of new semantic search tools embedded in imaging IT platforms. Europe on the other hand, with less aggressive EMR adoption and a more fragmented market, may find that its lack of enterprise focus will limit adoption of these new tools.

Furthermore, advances in artificial intelligence in radiology will require access to large pools of medical imaging and associated patient data. While AI is its infancy today for medical imaging, the structure of the European market may hinder market development and the rollout and adoption of AI-based diagnostic tools. Europe is already somewhat at a disadvantage in the AI development race, given that its main competitors in North America and China both have far larger population cohorts to use in training and testing. While there have been some initial moves in Europe toward initiatives to open up siloed datasets, such as in France with the G4 "AI imaging ecosystem," too little has so far been done at a coordinated national or pan-European Union level to support the growth of this technology sector. Moreover, implementation of AI in clinical practice will also suffer unless more is done at regional, national, and international levels to address interoperability between radiology systems and other health datasets.

Stephen Holloway.

Stephen Holloway.Combined, these factors point to some clear risks for European radiology. Without a significant change, it could fall behind as the shift to interdisciplinary care, centralized procurement, and AI intensifies. Otherwise, European radiologists could lose a golden opportunity to be central in the future of diagnosis and care provision.

Steve Holloway is a principal analyst at Signify Research, a U.K.-based independent supplier of market intelligence and consultancy to the global healthcare technology industry.

Originally published in ECR Today on 1 March 2019.

Copyright © 2019 European Society of Radiology