The European CT market is experiencing a challenging period. Increased awareness of radiation dose, limited healthcare budgets. and increased use of ultrasound and MRI are all having an impact on demand for new CT equipment.

Following a market decline of approximately 25% since 2008 in the midst of continued economic uncertainty, the outlook for CT equipment could be viewed as bleak. However, it is often in adverse times that the greatest shift in product development and innovation occurs; suppliers are forced not only to focus on advanced features, but also on improving the day-to-day basic equipment use. While many of these innovations rarely make the industry headlines, they bring about significant improvements for most users.

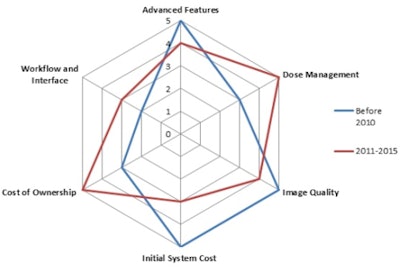

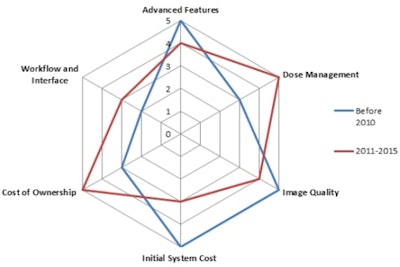

For example, outside of high-end cardiology and research institutions, the majority of CT scans performed will not use advanced visualization tools or 320-slice scanners. Instead, the real need of the majority is for cost-effective CT imaging equipment, incorporating dose management, good resolution, and, increasingly, efficient workflow and simple integration to existing healthcare IT systems. Recent new system releases from CT suppliers are starting to exhibit such characteristics, highlighting the shift in supplier focus.

Dose reduction remains the hottest topic in CT, with a range of new innovations recently released to help providers track, manage, and reduce radiation administered. While many new dose reduction solutions have been brought about through technical changes during scanning, some suppliers are offering other schemes to assist the push for dose reduction. Examples of these strategies include supplier onsite dose reduction assessment and advice, integrated dose management and tracking software, and plans to produce a universally applicable scale allowing dose comparison between CT scanner types.

Scale: 5 most important, 1 least important. Source: InMedica.

Scale: 5 most important, 1 least important. Source: InMedica."Workflow" and "user interface" are two other increasingly common terms in manufacturers' marketing material, and they are having a significant impact on CT use. A big change in the last few years has been facilitating faster scans and postprocessing, using faster computer processing, predefined user settings, and integration with hospital PACS and electronic medical record (EMR) systems. Combined, these small improvements make a significant time and cost savings for users. Moreover, if used with computer-modeled throughput management, patient and scan volumes can be increased while reducing costs for the healthcare provider.

Manufacturers are also adapting to the change in users' perception of the cost of ownership for advanced imaging equipment. "Lifetime" cost of CT equipment was rarely discussed prerecession, with advanced features and high-resolution images dominating most users' decisions. Yet, with the average life span of CT equipment in Europe increasing amid widespread austerity cuts, lifetime cost of ownership has rapidly come to the fore.

This trend has led to major changes in service and warranty models, especially as competition for dwindling tender contracts increases. Schemes offering longer equipment warranties, "wear and tear reduced" imaging modes, and more flexible service contracts are intended to reduce the burden of rising advanced imaging service expenditure.

This shift in manufacturers' focus should be welcomed within the imaging community. While some may prefer further advanced diagnostic tools specific for radiological imaging, most observers would agree that the new generation of CT scanner is a step in the right direction for the majority of users. In the short term, manufacturers of CT equipment will also not benefit significantly from a surge in sales in the uncertain economic climate.

Production of systems that improve the cost of advanced imaging will undoubtedly lead to greater use and more accessible, safer CT systems. That said, manufacturers should also continue to invest in future technology and the next generation of advanced CT systems; pushing the boundaries of imaging technology is key to maintaining the relevance of CT imaging. Finding the correct balance between development of brand-new CT technology and refinement of current CT technology is a significant challenge for suppliers. Austerity looks set to continue over the coming years, and it appears the balance will be heavily weighted to the majority of users for the foreseeable future.

Stephen Holloway is a senior market analyst in the medical imaging research group at InMedica, a division of IHS (NYSE:IHS). InMedica is a leading provider of market research and consultancy in the medical electronics industry (www.in-medica.com).

Originally published in ECR Today on 8 March 2013.

Copyright © 2013 European Society of Radiology