Growth in the global CT market has been restricted by a number of factors over the last five years. The economic downturn in 2009 resulted in a significant decline, from which many developed markets are only now starting to recover.

Following the rapid succession of new systems offering increased slice technology, many observers thought dose reduction would be the next wave of technology innovation to grip the market. There has certainly been a concerted effort to develop radiation dose-reduction software and monitoring, with numerous systems refining this technology launched between 2012 and 2014. Perhaps more importantly, scrutiny over protocols and evaluation of the overuse of CT in many disciplines has had two major consequences: firstly, greater focus on clinical application; secondly, development of systems to streamline patient care.

Three key trends are emerging as drivers for technology innovation in 2015: automated workflow, scalability, and clinical focus.

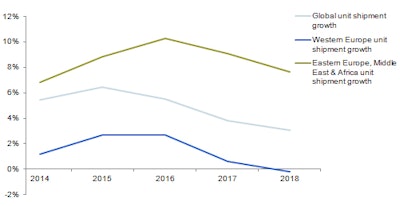

Comparative four-year unit shipment growth for CT equipment in Western Europe, Eastern Europe, Middle East and Africa, and global.

Comparative four-year unit shipment growth for CT equipment in Western Europe, Eastern Europe, Middle East and Africa, and global.Automated workflow: Unscheduled CT scans from the emergency department account for approximately 40% of all CT scans in the hospital. This means they are largely explorative and take up valuable time and money. Streamlining patient care in this type of scenario will significantly increase patient throughput and return of investment for hospital providers. Manufacturers have made significant advances in reducing the length of scan in CT exams. It is argued by many now that scan speeds are as short as they can be.

Scalability: Across the board, market leaders Siemens Healthcare, Philips Healthcare, Toshiba Medical Systems, GE Healthcare, and Hitachi Medical Systems are now offering scalable systems. The majority of equipment is available in a number of slice configurations, with the option of virtual scan software to increase analysis and image resolution. This allows the technology to be utilized by a wide range of users in a variety of developed and emerging markets.

Clinical focus: Increased clinical focus is not a new trend to the medical imaging market. CT has shown superior imaging for lung cancer, and early detection of cystic fibrosis in addition to cardiac and pulmonary diagnosis. Over the past two years, interest in systems tailored toward these specific care areas has intensified. Despite radiation concerns, there is a preference for the use of CT over other imaging modalities in these applications. Furthermore, a focus on minimally invasive interventional procedures has also generated attention. Focus and refinement of systems for specific clinical applications that help support physician workflow will enable vendors to experience heightened growth in the developed, saturated markets of the U.S. and Western Europe.

To further increase patient throughput, the complete CT protocol needs to be considered. Automated workflow features and preprogrammed standard scans are increasingly seen in new CT systems. Furthermore, integration of CT equipment with healthcare IT systems allows images to be quickly accessed and analyzed. This aims to significantly speed up unscheduled and scheduled CT scans, allowing equipment to be utilized by an increasing number of patients. Speeding up the overall protocol of CT exams is vital to offset declining reimbursement for CT equipment, particularly in the developed U.S. market.

Furthermore, scalable systems allow multinational suppliers to develop their installed base in emerging regions. Basic configuration systems can be purchased at lower cost by first generation users. As their requirements develop software add-ons, upgrades and additional features can be purchased. This type of flexibility is increasingly common particularly in the high-cost medical imaging market such as CT where technology from leading manufacturers is desired, but the up-front cost restricts purchasers in emerging markets.

The "golden age" of the CT market is now a distant memory. Manufacturers are today expected to "prove" the clinical excellence and improved clinical outcomes of their systems to purchasers. Unit shipments of CT systems are projected to increase by 20% over the next five years, and long-term cost savings will be at the forefront of purchasing decisions. Consequently, those suppliers that can develop a portfolio inclusive of scalable, automated, and clinically focused equipment will reap the rewards in the long term.

Nicola Goatman is a senior analyst with IHS Medical Technology. It provides market research and consultancy services to the medical device industry. Coverage includes medical imaging equipment, clinical care devices, healthcare IT, consumer medical devices, medical displays and wearable technologies.

Originally published in ECR Today on 6 March 2015.

Copyright © 2015 European Society of Radiology