The case for data centers acting as central repositories of medical images is fast being appreciated in the advanced European PACS markets, but appreciating and adopting are proving to be two entirely different issues. Indeed, less than 5% of total PACS installations in Europe in 2010 were connected to a vendor-neutral archive (VNA).

Medical image repositories or imaging data centers are an evolution of the healthcare IT market. They allow central archiving and retrieval of images from a disparate PACS, either in different departments or at other hospital sites. They may be installed as part of a single hospital's enterprise strategy to consolidate patient images and allow a comprehensive view of a patient's records across the care continuum.

These centers can help reduce exam duplication, as well as allow specialists and general practitioners to effectively collaborate and obtain better clinical decision support. They may also form part of the enterprise strategy in a multihospital environment. In this case, the aim is to allow access to patient images by all the sites within the hospital group, even if each hospital has a PACS from a different vendor. These archives may also mitigate data migration challenges associated with replacing a current PACS, enabling a plug-and-play environment where PACS focuses on the end-user functionality rather than on the archiving of images.

A PACS may improve workflow for radiologists, but further consideration must be given to archiving and storage of images. Image courtesy of Philips Healthcare.

A PACS may improve workflow for radiologists, but further consideration must be given to archiving and storage of images. Image courtesy of Philips Healthcare.In Europe, the adoption rate of VNAs is significantly higher in multihospital environments than in single sites. This correlates with a growing multisite PACS market where groups of hospitals, either private consortia or regional health networks, collectively initiate a PACS project for a number of hospitals with a single vendor.

A major challenge hospitals face in adopting an imaging data center in a multisite environment stems from a vendor's capabilities and willingness to help. There is a stark difference between a central PACS archive that aggregates images from a vendor's own multiple PACS and a true VNA. In multisite projects, a PACS supplier may provide a central archive. The real question is what happens a few years down the line when one of those hospitals opts to replace the vendor's PACS with that of another vendor? Similarly, what happens when the group wants to integrate another hospital to the network? Can this be done, even if the incoming PACS is from a different vendor to that providing the central archive, and without corrupting data quality?

Hospitals must ensure that a data center is not just vendor-neutral so long as it is storing images from one vendor (much in the same vein as the Ford Model T -- "Any color so long as it is black"). We estimate that less than 15% of large multisite PACS projects in Europe in 2010 were provided with a true VNA. Only when hospitals begin to engage vendors to tackle these questions as part of a long-term enterprise strategy will VNA adoption increase substantially.

This raises another challenge to the adoption of VNAs: the lack of clear, long-term enterprise strategies for archiving medical images within European hospitals. For single-site hospitals, an enterprise strategy may aim to connect disparate departmental records -- images or otherwise. While electronic medical records that centrally store patient demographic and test results are highly penetrated in European hospitals, the central storage of all images is significantly less available.

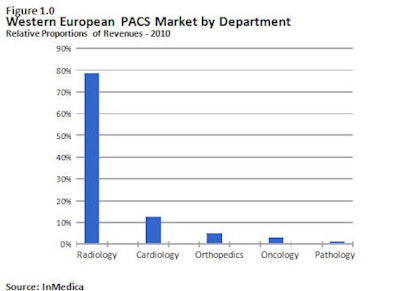

Part of the issue here is that many European hospitals do not currently have PACS for different departments, a prerequisite for developing a strategy to interconnect these. In 2010, departments other than radiology were estimated to account for less than 22% of total PACS revenues in Europe (see figure 1). As the cardiology, orthopedics, oncology, and pathology PACS markets grow, so too will the need for interfacing, integrating, and central archiving.

Where there are existing PACS for different departments, the predominant current trend is to focus on interfacing these PACS via Integrating the Healthcare Enterprise (IHE) protocols. This is certainly a positive step toward an image enterprise strategy, and many currently available PACS are compatible with IHE protocols. However, data are still kept within each PACS separately, rather than centrally as in the VNA.

In single-site hospitals, the trend will continue to be for interfacing of disparate PACS via IHE protocols, rather than central archiving. Interfacing via IHE protocols, such as XDS-I, achieves many of the benefits of VNAs, including cross-departmental data sharing. Its disadvantage, however, is that the hospitals still need to undergo a costly data migration and reinterfacing process when each PACS is replaced; this is avoided in a VNA situation. On the other hand, interfacing different PACS rather than central archiving prevents the possibility of complete data loss of all images should the VNA be corrupted, fail, or be aborted in the implementation stages. This seems to be a major concern for many hospitals in Europe. Consequently, although the trend for interfacing of different PACS via IHE protocols is beneficial in driving an enterprise model for imaging, it will continue to hinder the growth of the VNA market in Europe.

Theo Ahadome is an analyst at InMedica (www.in-medica.com), the medical industry research group at IMS Research. The information in this article was obtained from InMedica's research and reports on the worldwide PACS and medical data storage markets. For more information, please contact Diane Wilkinson at [email protected] or +44 1933 402255.

The comments and observations expressed herein do not necessarily reflect the opinions of AuntMinnieEurope.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.